As the Great Lockdown slowly comes to an end, we will soon witness the damage our flawed models and technologies – including our healthcare systems – have caused to this planet, having lost nearly half a million lives globally. The pandemic has reinforced the links between health, environment, and the economy. If not only our progeny, we owe it to the families of those who lost their loved ones to build a better, greener world forward.

The Current Landscape

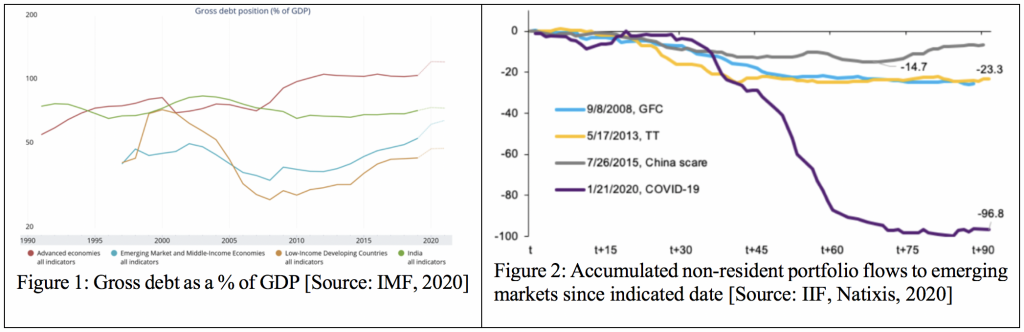

Prime Minister Modi’s decision to impose lockdown in India was always a Catch-22 decision. On the one hand was the decision to salvage an already plummeting economy, and on the other, saving India’s populace from the scourge of COVID-19. With the announcement of the obscure ₹20 lac crore (or US$ 265 Bn) stimulus over the next 3 years, some confidence may have been restored in the minds of investors and consumers at large, but the work is far from done. The package has been criticised by economists for being far lower than the government-quoted figure, and for doing little to revive the economy or alleviate the plight of farmers, migrant workers, and MSMEs. Furthermore, India’s gross debt is one of the highest in the world today (Figure 1), and it runs the risk of downgrading India’s sovereign BAA2 Negative rating to the junk category. This is bound to drive off investors at a time when India needs them the most: firstly, for its immediate fiscal programme that requires international investors to partner with country’s public and private sectors, and secondly, for the already soaring outflows from Asia because of COVID-19 (Figure 2).

On a brighter note, India has a record US$ 487 Bn in central bank reserves as possibly the soundest monetary pool that can protect state and private banks from heavy write-offs in the future, and prevent the Rupee from depreciating further.

On a brighter note, India has a record US$ 487 Bn in central bank reserves as possibly the soundest monetary pool that can protect state and private banks from heavy write-offs in the future, and prevent the Rupee from depreciating further.

Against this landscape, it is becoming increasingly challenging for state governments to sustain the lockdown for any longer, as is being witnessed by the opening up of most if not all economic activity in New Delhi by Chief Minister Kejriwal. At the Union level, the government requires to adopt a mix of fiscal and monetary policy measures that focus on promoting capital inflow and minimising capital outflow, as well as boosting employment and reinvigorating demand. A second step could be to effectively utilise the US$ 1 Bn in assistance provided by World Bank to the address the labour mobility crisis and appeal for the Precautionary and Liquidity Line (PLL; World Bank, 2020). This would be a six-month arrangement that provides an immediate liquidity credit line worth US$ 12.5 Bn, and could be used towards forgiving household debt and revamping the MNREGA wage programme. The Indian government will also need to find a way to cushion the demand-side shocks, including providing tax breaks, liquidity infusion, direct benefit transfers, etc. The onus may also fall on the RBI to perform long-term repo operations, provide liquidity to financial institutions, and ease the pressure on the rupee.

According to Fitch Ratings, India may post a 2% GDP growth in 2020-21, the slowest since the economy was liberalised 30 years ago, while the Asian Development Bank predicts that India’s economic growth may slip to 4% in the current fiscal. Although government priorities are health and economic revival, the coronavirus pandemic has presented an opportunity to policymakers to pursue sustainable growth and rebuild differently. This article aims at suggesting ways in which India can revive economic growth by following an environmentally sustainable route in its energy policy. Indeed, both goals are not mutually exclusive, and can in fact, be achieved simultaneously.

Interventions in Sustainable Energy

Sifting the geostrategic motivations to the coal reallocation scheme entrenched in the stimulus package, the goal of the Indian government should now be to balance hydrocarbon intensive emissions and jobs with greener ones. To this end, ill-reporting carbon intensive manufacturing units, cement industries, and automobile sectors in aviation and road mobility should receive conditional or no concessions. The conditions would be a mix of green jobs created; green investments made in technology; and emissions capped by December 2021.

Adopting this ‘flexi-security model’ is also critical to the skill development of unorganised labour, which can now be incorporated under the MNREGA scheme, and it also fits into the Intended Nationally Determined Contributions (INDCs) under the Paris Climate Accord (2015). INDCs are contributions determined by countries in the context of their national priorities, circumstances and capabilities.

It is also critical to define which job is green enough. This can be done by internally targeting emissions reductions or launching complementary schemes that greens the supply chain whilst creating jobs. For example, under the current stimulus programme, a provision for Smart Prepaid Meter Installation can be complemented with a unified aluminum wiring program for households. This makes the sector competitive and has the potential to invite companies on a revenue sharing basis. Similarly, providing incentives for solar PV and battery storage manufacturing are likely to cause capital inflow into India. Given current greenhouse gas emissions and the uncertain economic landscape, various countries intend to shift their portfolio of battery manufacturing units from China to India, Taiwan, Japan, Malaysia, and Vietnam. Capital inflow in sustainability also brings technology transfers, which can immediately cap India’s fiscal spending on reconstruction.

Even though India may become a hub for sustainable utilities manufacturing, it will also be vilified for its coal programme that intends to produce more than 1 Billion tons of coal by 2024. Instead of engulfing the country in smoke, the government should consider leveraging the global overcapacity in steel and focus on a mix of gas (from Central Asia) and renewables for energy security. It is also important to consider that financing coal will now come at higher costs internationally as financiers begin to pull away from it.

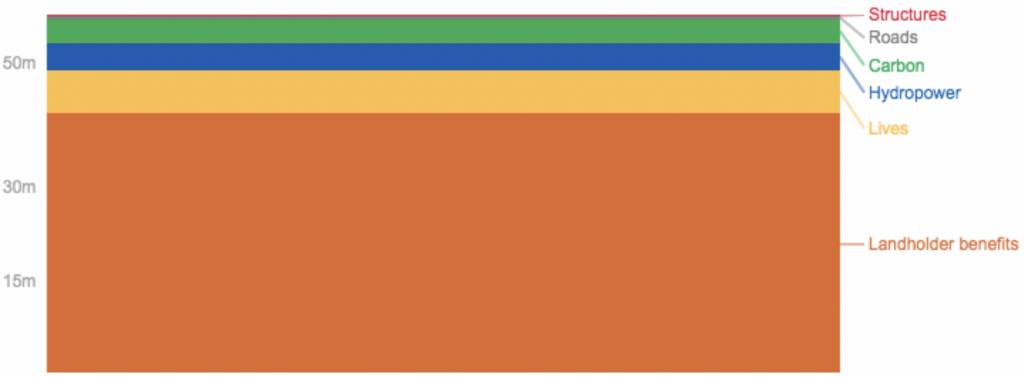

Moreover, with a growing implementation of a carbon price in the international stimuli, India’s emissions should be complemented with carbon capture storage to contain it for its own good; this is not being discussed even remotely. Nevertheless, let us assume the government is immune to unanimity on a global scale. In that scenario, having a public works programme that promotes agricultural landholder benefits, initiating a forestry programme that acts as a carbon sink, and launching structures with retrofits and hydropower will help create jobs in the next decade to offset coal dependence as well.

Figure 3: Benefits across a range of sectors in excess of watershed management investment costs US$ 50 million [Source: World Bank 2019]

Figure 3: Benefits across a range of sectors in excess of watershed management investment costs US$ 50 million [Source: World Bank 2019]

Conclusion

The interlinkages between sustainability, job creation, and economic growth are well established. Indeed, in the aftermath of the global financial crisis of 2008 – 2009, South Korea directed 70% of its fiscal stimulus towards green measures, and it rebounded faster as compared with other Organisation for Economic Cooperation and Development (OECD) countries. Similarly, USA’s investment in clean energy and public transport created more jobs than traditional investments.

Policymakers in India, too, should see merit in pursuing green growth in a post-COVID world. As such, the sustainable energy programme could be run by special purpose vehicles set-up by institutions apart from the government. The factors determining the intervention would be jobs growth, income multiplier, and cumulative benefits for each stakeholder. Given that the economy is projected to grow at 1.9% in 2020 and that it is disintegrated in the supply chains from the world, now is the time for India to step up its international network of diplomacy and instead of being ‘Atma Nirbhar’ or deglobalised, attract inflows to support its people and economy.

References:

(2020, May 7). Government of India: Update following forecast change. Retrieved May 28, 2020, from https://www.moodys.com/credit-ratings/India-Government-of-credit-rating-401565?stop_mobi=yes

Karaban, E. (2020, April 2). World Bank Fast-Tracks $1 Billion COVID-19 (Coronavirus) Support for India. Retrieved May 28, 2020, from https://www.worldbank.org/en/news/press-release/2020/04/02/world-bank-fast-tracks-1-billion-covid-19-support-for-india

NARAIN, U., & BHAMMAR, H. (2020, May 12). A green economic recovery for South Asia. Retrieved May 28, 2020, from https://blogs.worldbank.org/endpovertyinsouthasia/green-economic-recovery-south-asia

World Economic Outlook, April 2020: The Great Lockdown. (2020, April 01). Retrieved May 28, 2020, from https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

Herrero, A. G., & Ribakova, E. (2020, May 21). Solutions to deal with emerging economies’ dependence on external. Retrieved May 28, 2020, from https://voxeu.org/article/solutions-deal-emerging-economies-dependence-external-funding

Quéré, A. B., Marimon, R., Martin, P., Ferry, J. P., Reichlin, L., Schoenmaker, D., & Weder di Mauro, B. (2020, April 20). Repair and reconstruct: A Recovery Initiative. Retrieved May 28, 2020, from https://voxeu.org/article/repair-and-reconstruct-recovery-initiative

Beniwal, V., & Nag, A. (2020, May 18). $277 Billion Package May Not Give Immediate Boost to India. Retrieved May 28, 2020, from https://www.bloomberg.com/news/articles/2020-05-18/-277-billion-package-may-not-give-immediate-boost-to-india?sref=us8o2y4t

Fiscal Monitor – April 2020. (2020, April 01). Retrieved May 28, 2020, from https://www.imf.org/en/Publications/FM/Issues/2020/04/06/fiscal-monitor-april-2020

Finance Minister announces new horizons of growth; structural reforms across Eight Sectors paving way for Aatma Nirbhar Bharat. (2020, May). Retrieved May 28, 2020, from https://pib.gov.in/PressReleasePage.aspx?PRID=1624536

Ray, D., Subramanian, S., & Vandewalle, L. (2020). India’s lockdown (No. BOOK). Centre for Economic Policy Research.